A deep dive into how Gnani.ai’s real-time agent assist makes every agent your top performer

About Assist365

Assist365 is the real-time agent assist module on Gnani.ai’s unified customer experience (CX) platform. It was designed to reduce the scope for human error while handling customer interactions. It leverages generative AI to provide agents with hints, checklists, guided workflows and more. Assist365 also deciphers caller sentiments and analyzes emotions to suggest next best action plans to agents.

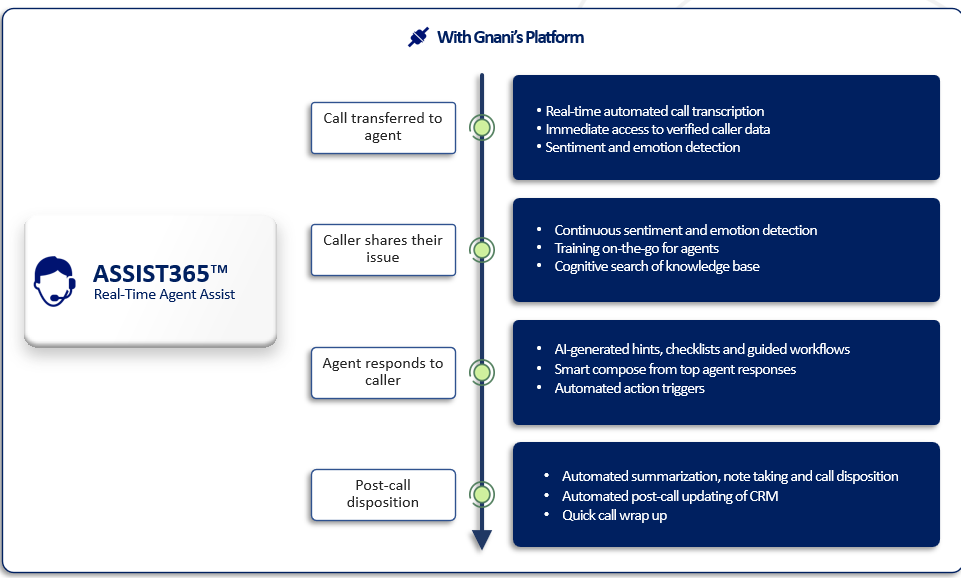

Agent Journey on Assist365

Assist365’s real-time agent assistance capabilities powered by generative AI help agents address customer issues fast and efficiently. These are the ways in which Assist365 helps agents:

- Automatic call transcription: Through Assist365, the call is automatically transcribed right from the start. This saves the agent’s efforts in transcribing the call.

- Faster resolution: As soon as the call connects, agents get access to verified caller data through Assist365. So, they can get to solving the issue right away. It saves the time it would take the customer to reiterate their issue.

- Constant sentiment and emotion detection: Assist365 detects sentiments and emotions from the customer’s interaction with the bot and notifies the agent throughout the call.

- Reduced ramp time: Agents can be trained on the go using Assist365’s immediate reinforcement feature. Learning on the job is best suited for agents. Thus, the immediate reinforcement feature helps agents understand what they are doing correctly and which areas they must improve on.

- Cognitive search: Assist365 facilitates a cognitive search of the knowledge base. Having quick access to relevant information makes problem solving much easier for agents.

- Real-time guidance: Generative AI is leveraged by Assist365 to helps agents with hints, checklists, and guided workflows. This ensures that call quality is maintained irrespective of the agent handling it. Also, if the agent feels stuck at any point during the call, they can refer to these checklists and workflows to address the customer issues.

- Smart compose: Assist365 has a smart compose feature which suggests responses based on top agent responses. This is immensely helpful for agents if they are feeling stuck. In other cases, it just reduces the time taken in addressing customer issues.

- Automated action triggers: Automated action trigger action buttons are available to agents. For instance, if a caller asks the agent to block their card, the agent just has to press the block card button to trigger this action.

- Post-call summary, note taking and disposition: Call summarization, note taking, call disposition and updating of CRM are also automated via Assist365. This reduces post-call workload for agents.

- Customer and agent satisfaction: Assist365 also helps agents in wrapping up calls quickly and politely. The brand voice is maintained through consistent call wrap ups.

Without An Agent Assist Module

If a CX platform does not have a real-time agent assist module like Assist365, this is what happens:

- Training agents is a time-consuming process for managers. Without Assist365’s training on-the-go features, ramp time is generally much higher.

- Agents might have to read through the information to find the right guidance while trying to listen actively. This leaves more room for errors.

- Agent might not know how to deal with negative sentiments of the customers. They might not have the right thing to say even in positive conversations.

- There is no support or guidance if an agent is stuck solving a customer issue.

- Post-call workload for agents is much higher as they have to manually summarize calls and update the CRM.

Check Gnani.ai’s Assist365 for yourself. Click here.

Generative AI: Redefining Agent Assistance Software -

[…] interact with their customers. This blog looks at the world of generative artificial intelligence, agent assistance software, and their profound impact on customer […]

How to Automate Cold Calls and Embrace AI – Gnani.ai

[…] Automate365 is a game-changer for BFSI and NBFC companies. Here’s why: […]